Table of Content

The initial upfront expenses of buying, or buyers who only plan on holding onto the property for a few years before selling it. And, if you’re ready to jump right in, our home loan comparison tables are the perfect place to start your search. You’ll need to find an offer that suits your budget and agree to another mortgage term. Most people opt for a 25-year term when they get their first mortgage, but that isn’t necessarily the right choice for you. Once equity is built, the borrower can buy a bigger and more expensive home.

We have options that could help make your home loan work for you. If you are concerned about repaying your interest-only mortgage at the end of the term, it's best to look at solutions now and not later. The closer you get to the mortgage end date, the few options you will have available.

Advantages & Disadvantages of Interest Only Loans

However, if you are an early-mid career investor and you have a sizeable mortgage on your own property, it could be a great idea to go for an interest-only loan on your investment properties. Ella Dromgool, a mortgage broker from Catalyst Financial, is in favour of interest-only loans, especially if the investor has their own home mortgage as well. However, if the loan was initially put on an interest-only mortgage, the weekly repayment would be $384.62, saving $143.12 per week. If this was a standard principal and interest mortgage, then the weekly repayment would be $550.50. But this gets difficult as you keep doing this, because the bank will test your income to see if you can afford to pay off the loan in the time you have left on it. Two things can happen at the end of your initial 5-year interest-only period.

While an interest-only mortgage will reduce your borrowing costs in the short term, you end up paying more overall. That’s because you keep paying interest on the full amount you borrowed. There is a lot of headline thinking here, but 'interest only' covers a wide range of very different things. Certainly there are situations where it is interest only because the borrower is stretched to the max on cashflow, thus a very dangerous thing.

Kiwibank 5 Year Fixed

Cash advances, a competitive interest rate and the bank's rubber stamp ready to approve. Can you imagine walking into a bank asking for an interest free loan to fund your speculative share investment portfolio? Good luck convincing the bank, plus even if you got your loan it would be at the bank's higher business interest rates.

While we are independent, we may receive compensation from our partners for featured placement of their products or services. Persistently high inflation could see back-to-back increases to the cash rate, according to a new Finder poll. Lenders are still careful when assessing interest-only borrowers.

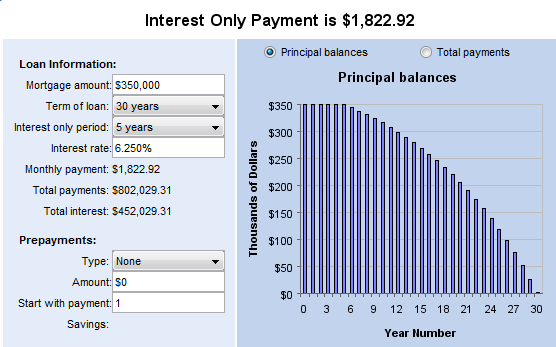

Interest Only Loan Calculator

To see which banks offer interest-only loans and compare your options, check out Canstar’s home loan comparison tables. This interest-only mortgage calculator will help you find out what payment you will pay based on the interest-only payback portion for your loan principal. This result will likely be lower than a standard mortgage payment as it calculates your obligation for the interest-only portion of the mortgage, rather than the principal and interest.

This means, at the end of that 5-year period, your loan will move to principal and interest by default. In fact, even on an interest-only loan the property will likely have negative cashflow, at least initially. Because you are only paying interest; the size of your loan never decreases.

Our calculator shows you what an interest-only mortgage's repayments will be and reveals the total costs of an interest-only mortgage. Our guide to interest-only mortgages explains the pros and cons of such an arrangement in detail. Next, you need to understand how long your interest-only period lasts. If you don't know or can't remember, check with your lender. You can prepare for the end of the interest-only period by using a mortgage repayment calculator and checking how much your repayments will increase with principal and interest repayments. To compare different home loan options, check out New Zealand’s outstanding value home loans using Canstar’s home loan comparison tables.

There are no set repayments, but your balance needs to stay below the limit at all times. This means that your balance may fluctuate up and down depending on your spending habits. For this type of loan you are only paying interest on the balance of your loan, not your limit. Interest-only mortgages can, however, be useful for some investors. They’re also sometimes used by people who want to free up cash for the first year or two, to cover their initial purchase costs or urgent improvements. Another use is for short-term bridging finance, which is when you need to pay for a new home before you get paid for your old one.

Because you will still have to repay your loan before your maturity date, your limit reduction amount after the non-limit reducing period will be higher than before. When signing up to a Westpac home loan, you have a choice in how you repay the principal and the interest. Different loan types enable you to repay in different ways. Lending criteria, terms, conditions and fees apply to this offer. It can help your application if you lower the borrowing amount by making a lump-sum payment and put more equity into the underlying property. Repayment mortgages have the advantage of reducing the loan owed over time, and therefore the amount of interest charged.

But there are also loans where the borrower is technically on interest only, but also has capacity to repay capital at a high rate, and is. But I hate debt and will repay this completely over two years or so. I can dump a big amount of cash into it each month and a couple of times a year along comes a lumpy windfall so I knock that off the loan as well.

However, over their lifetime, interest-only loans are more expensive than principal and interest loans (P+I). A whopping 42% of investors who are taking out a new mortgage are taking out an interest-only loan, according to the Reserve Bank of NZ (May 2021 – April 2022). After all, paying off the principal means that interest would be charged on a smaller amount, which reduces the dollar amount of the tax deduction.

So paying down personal debt frees up useable equity, whereas paying investment debt may not. In fact, the higher payments mean you may end up paying more for your house overall than you would if you had a shorter interest-only term, or a normal P&I loan. This could lead you to rely on this extra cash-flow for your living expenses without thinking about the fact you’re not actually investing in anything worthwhile. A repayment mortgage means your monthly payments are calculated so that what you pay includes some of the loan amount and the interest, meaning you are repaying the loan over the term. For most Kiwis buying their first home or remortgaging, the longer the deal term is better. However, as most lenders will charge you for early repayment or overpaying your mortgage, it is essential to consider how long you want to be tied in for.

A mortgage broker may be able to help;our guide explains everything you need to know about their services.Mortgage brokers don’t charge for their services directly and are only paid if you go ahead. Their experience is unrivalled, and they will happily answer your questions about all things concerning the process of owning a home. Floating home loansFloating home loans are mortgages that have an interest rate that can change at any moment, usually when the Reserve Bank of New Zealand changes its interest rate but not always. The Federal Reserve has hinted they are likely to taper their bond buying program later this year. You can also set up your home loan as an interest only loan but only for a specific period.

Banks have been shortening their typical interest-only periods and making it harder to extend them. You mostly have to re-apply for the loans which can prove to be a problem if your income situation has changed significantly or if you cannot meet the newer serviceability tests. The bank does not use the interest repayments you currently have as their basis for calculations of affordability, and they test at much higher interest rates. The main difference is interest-only home loans result in lower monthly payments for the first few years of your loan, but this means you’ll be paying higher interest payments over the life of the loan.

No comments:

Post a Comment